Appreciate our quality journalism? Please donate here

EXCLUSIVE

The private company paid $110,000 to conduct an “independent review” into the corporate regulator has refused to stand by the Federal Government’s claims that it made no findings of wrongdoing against regulator bosses James Shipton and Daniel Crennan.

Canberra-based CPM Reviews, a “go-to” investigator favoured by the Federal Government, has also refused to back Treasurer Josh Frydenberg, who in January further unilaterally declared that Shipton had done nothing wrong, despite providing no evidence to back that claim.

As reported last week, current Australian Securities and Investments Commission deputy chair Karen Chester – the only person at the helm of the regulator not personally mired in the “relocation expenses” scandal – has also refused to stand by Frydenberg’s claims that Shipton engaged in no wrongdoing.

That means the private company paid to conduct the ASIC review; the review’s author, Dr Vivienne Thom; and the top official at ASIC, who is not personally involved in the scandal, have all refused to stand by Frydenberg’s claims.

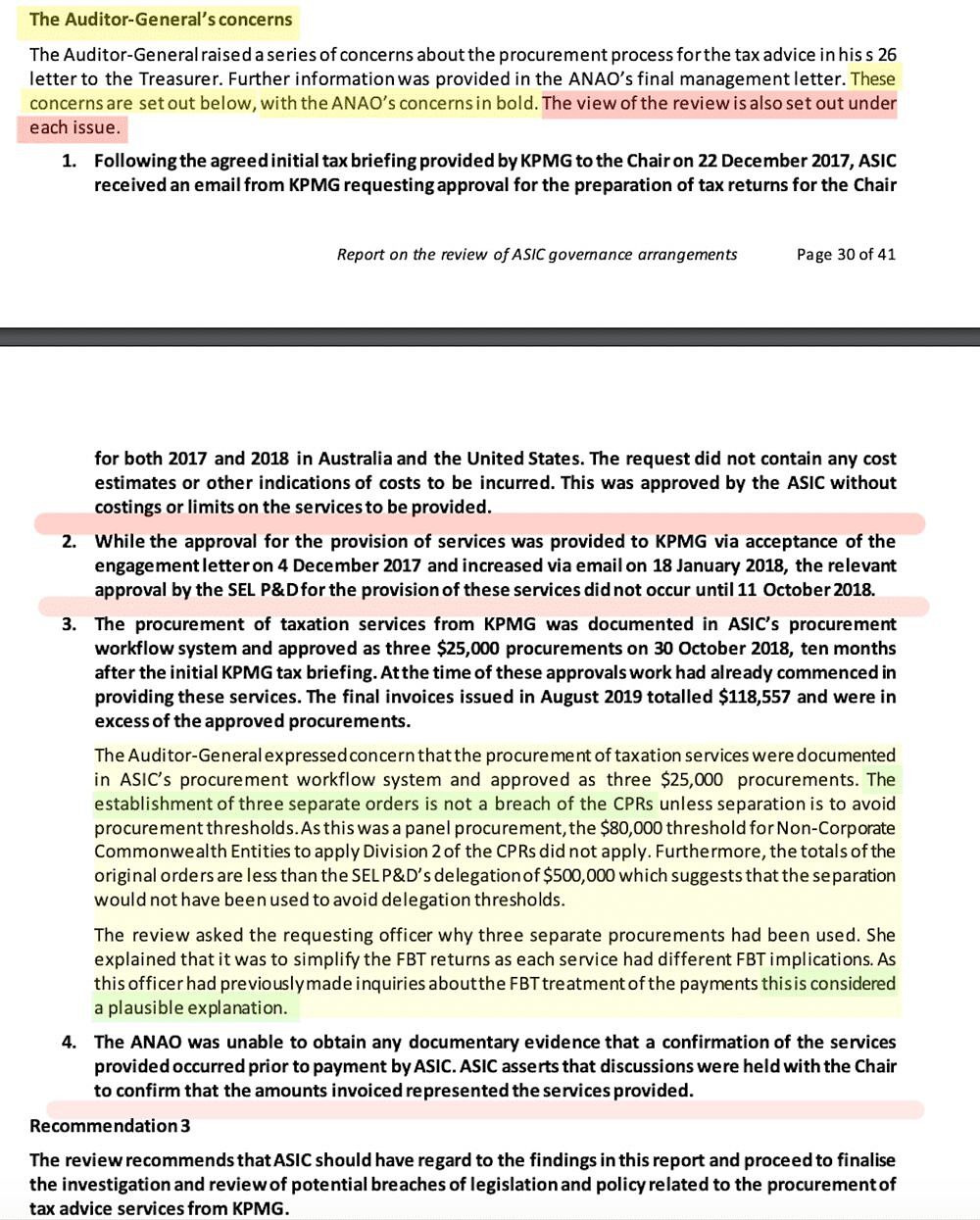

As revealed by The Klaxon last week, the Federal Government secretly deleted three of the four findings the ASIC review made regarding Shipton and $118,557 in personal “tax advice” he charged taxpayers.

The only finding not deleted relates to a single matter which did not identify wrongdoing by Shipton.

Pages 30 and 31 of Frydenberg’s doctored version of the Thom report, deletions highlighted in red. Source: Treasury. Emphasis: The Klaxon

CPM, which receives well over $1 million a year from taxpayers for conducting “reviews”, many of which never see the light of day, has refused to back-up Frydenberg’s claims, repeatedly refusing to comment when approached by The Klaxon over the past three months.

How The Klaxon broke the story on February 23. Source: The Klaxon

The author of the ASIC review, Dr Vivienne Thom, resigned from her senior role with CPM immediately after Frydenberg on January 29 released a doctored, “abridged”, version of her report.

Frydenberg simultaneously declared – though he provided no evidence – that Shipton had done nothing wrong.

The Treasurer has never released Thom’s actual report, which she completed on December 17.

(The day before, on December 16, Treasury inexplicably gave CPM an extra $60,000 to conduct the review, taking its total cost to $110,000, AusTender documents show).

Thom was previously Australia’s Inspector-General of Intelligence and Security, with oversight of the nation’s six spy and intelligence agencies.

She joined CPM after her five-year term ended in 2015.

Despite Frydenberg’s comments – and despite the secret deletions – the version of Thom’s report that has been released still clearly shows that the vast majority of Shipton’s $118,557 “tax advice” was illegal.

It contains direct, specific, evidence from the nation’s top auditor, the Australian National Audit Office (ANAO), that just $1,917 – less than 1/60th – of the payments were legitimate.

The ANAO found the only legal component of Shipton’s KPMG “tax advice” was the $1,917 paid for an “initial tax briefing” ahead of Shipton’s relocation from the US to Australia.

KPMG provided the additional $116,640 in “tax advice” services at Shipton’s direct request.

How The Klaxon broke the story on March 16. Source: The Klaxon

Over many months ASIC was repeatedly instructed by the ANAO – ASIC’s own auditor – to get a formal response from government body the Remuneration Tribunal regarding the legality of the Shipton and Crennan payments.

Shipton’s ASIC has repeatedly refused to do so.

The $118,557 “tax advice” was provided by private consultancy KPMG.

As previously revealed by The Klaxon, KPMG had also been running ASIC’s “internal audit” operations, in a situation representing a clear, serious conflict of interest.

(Under the internal audit arrangement, which ran for at least four years, KPMG was paid around $550,000 a year).

The Thom report also shows $69,621 payments to then ASIC deputy Crennan were all illegal, and illegal from the outset.

Crennan himself admits this in the Thom review.

He resigned from ASIC when the scandal broke in October.

The ANAO is overseen by Auditor-General Grant Hehir, the nation’s top auditor.

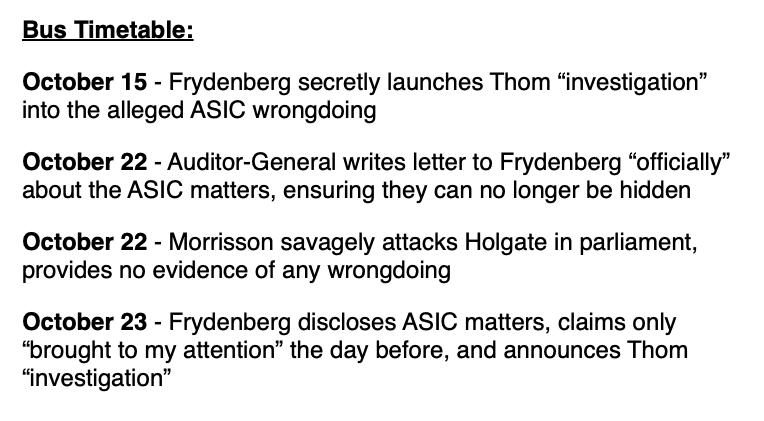

The Shipton and Crennan scandals only became public knowledge after Hehir, fearful of an ongoing government cover-up, forced the matters into the open by taking rare, anti-corruption, legislative action.

The ANAO’s funding has been cut substantially by the Federal Government, drawing strong rebuke from Hehir, who says the cuts mean the government agency can’t afford to do its job properly.

Longo and Bond

The Federal Government yesterday announced the replacement for Shipton, who will leave the regulator at the end of this month, barely half-way through his five-year term, will be corporate lawyer Joe Longo.

The appointment of Longo, who will start on June 1, has raised eyebrows.

Longo previously spent 17 years at Deutsche Bank, including as its general counsel for Britain and Europe, where it repeatedly fell foul of financial regulators.

Deutsche Bank has been mired in a series of global corruption scandals and was the lead player in “securitising”, packaging up for sale, dud US mortgages, which caused the global financial crisis.

In the 1990s, working for Perth firm Parker & Parker, Longo was the main legal representative for Alan Bond, Australia’s most infamous financial criminal.

Shipton, appointed under then Treasurer Scott Morrison, was previously an investment banker with globally notorious financial services group Goldman Sachs.

Yesterday it was also announced that Sarah Court, who spent the last 13 years as a commissioner at competition watchdog the Australian Competition and Consumer Commission (ACCC), would be appointed ASIC deputy chair, filling the vacancy left by Crennan.

Both Court and Chester will hold the position of ASIC deputy chair.

Findings of Fact

Despite the key deletions from Thom’s review – which both Frydenberg and Treasury have repeatedly refused to comment on – numerous “findings of fact” made by Thom remain in her report.

Thom identifies section 13(7) of the Australian Public Service (APS) Code of Conduct and section 14 of the ASIC Code of Conduct as having likely been broken by Shipton.

Yet on January 29 Frydenberg announced: “I am satisfied that there have been no instances of misconduct by Mr Shipton”.

“Nor have there been any breaches of applicable codes of conduct,” he said.

The Treasurer provided no evidence to support this.

In fact, the CPM report, commissioned by Frydenberg, actually puts matters back on ASIC, calling on it to “finalise the investigation”.

How The Klaxon broke the story on February 10. Source: The Klaxon

“The review recommends that ASIC should have regard to the findings in this report and proceed to finalise the investigation and review of potential breaches of legislation and policy related to the procurement of tax advice services from KPMG,” the review states.

ASIC, still being run by Shipton, has not done this.

A key test first test for incoming ASIC chair Longo, and new deputy chair Sarah Court, will be whether they complete the investigations into Shipton and Crennan and take legal action against the men.

Media Watch

Remarkably, newspapers The Australian Financial Review and The Australian, Australia’s two largest outlets for financial news, have published false reports regarding Shipton and Crennan over the past two days.

Both have continued to incorrectly report that CPM’s ASIC review “cleared” Shipton and Crennan of wrongdoing.

“Both were cleared of any wrongdoing in the independent review, enabling Mr Shipton to return as chairman until a successor was found,” The Australian’s Richard Gluyas incorrectly reported yesterday.

In the AFR, Michael Roddan, John Kehoe and Michael Pelly wrote: “The investigation cleared both Mr Shipton and Mr Crennan”.

The doctored, “abridged”, version of Thom’s report re-written by Treasury. Source: Treasury

The AFR even carried the glaring error in its “editorial”, today publishing that Shipton was “cleared by an inquiry”.

The “errors” are remarkable, given it has been public knowledge for months that the Thom review did not “clear” Shipton or Crennan of wrongdoing.

The Federal Government, having been aware of them for some time, first disclosed the ASIC matters on October 23.

That was the morning after Prime Minister Scott Morrison seemingly inexplicably attacked Australian Post CEO Christine Holgate in Federal Parliament over a matter that had occurred two years earlier and which involved no wrongdoing.

That “scandal” – Holgate had legally, and within guidelines, given luxury watches as bonuses to four Australia Post senior executives – dominated media coverage and served a s smokescreen for the far more serious matters at ASIC.

The government was forced to publicly disclose the ASIC matters because of rare, anti-corruption, legal action taken by Auditor-General Grant Hehir.

How Christine Holgate was “thrown under the bus” by the Coalition. Source: The Klaxon

Lawyer-up

Leaving his five-year term prematurely amid the expenses scandal is damaging to Shipton’s reputation.

He fought extremely hard behind-the-scenes to stay on as ASIC boss.

Shipton personally engaged a highly-expensive team of lawyers comprised of James Peters QC, Philip Crutchfield QC, barrister Nicholas Walter, and Dominic Gatto, of King and Wood Mallesons.

On January 29, at the same time as he released the doctored ASIC review, and claimed Shipton had done nothing wrong, Frydenberg simultaneously announced the ASIC boss would be replaced.

Frydenberg has been unable to explain why Shipton is leaving the regulator if he has done nothing wrong.

The fact that Shipton faces repetitional damage for leaving early amid the scandal, and that he spent large amounts of money on lawyers in a failed bid to clear his name and stay on as ASIC boss, underscores the fact the CPM review did not “clear” him of wrongdoing.

Both Shipton and Crennan repaid the money.

But only at the last minute.

Thom’s review shows that Shipton only told ASIC’s General Counsel on Oct 13 that he would repay the $118,557.

That was the day before Shipton finalised and signed ASIC’s 2019-20 annual report, in which he was legally forced to to disclose the payments.

“Repayment does not change the findings of the audit,” Auditor-General Hehir said in response.

More to come…