He identifies as a Christian, he’s active in the Anglican Church and he’s run one of the nation’s biggest theological colleges. He’s also a multi-millionaire who, for years, directed the international tax affairs of a global arm of multinational tax cheat Coca-Cola. Meet Anglicare CEO Grant Millard – the man responsible for Sydney’s notorious Newmarch House nursing home. Anthony Klan reports

Appreciate our quality journalism? Please donate here

EXCLUSIVE

The long-term CEO of one of the nation’s biggest “not-for-profit” aged care providers previously directed global tax affairs at an international arm of Coca-Cola – one of the world’s biggest confirmed tax cheats.

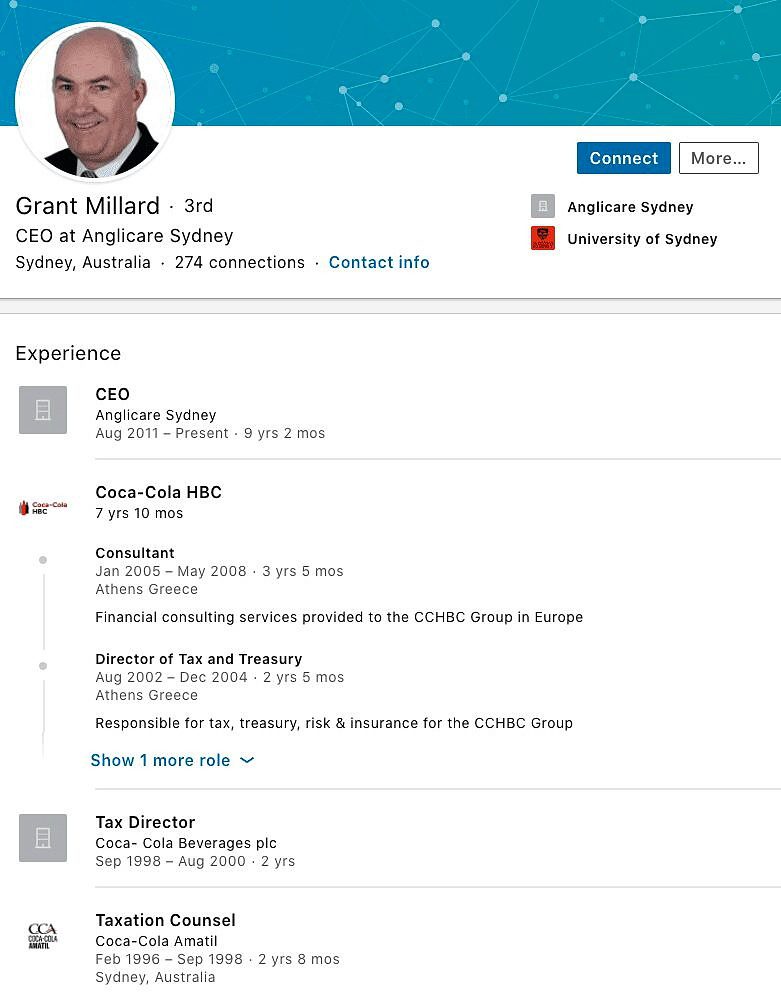

Grant Millard, the CEO of the Anglican Church run Anglicare, previously spent “a significant time” of his 13 years at Coca-Cola “at the helm of Coca-Cola’s aggressive global tax dodging strategies”, according to a detailed investigation by an expert tax-avoidance group.

The Centre for International Corporate Tax Accountability and Research (CICTAR) said before joining Anglicare, Millard had been “treasury and tax director” for Athens-based Coca-Cola Hellenic Bottling Company, S.A. (CCHBC), one of the world’s biggest Coca-Cola bottlers.

CCHBC, which operates in 28 countries, is part-owned by Coca-Cola (the main US company), and controlled by one of Greece’s wealthiest families via “holding companies” in Luxembourg and the British Virgin Islands (both prominent tax havens), CICTAR’s forensic report says.

Millard’s 13 years directing Coca-Cola’s global tax affairs included a period when Coca-Cola was “aggressively avoiding income tax payments”, depriving governments of billions of dollars that could otherwise be used to “fund health and social services”, CICTAR’s forensic report says.

“For a significant time of his 13-years at Coca-Cola, Grant Millard was at the helm of Coca-Cola’s aggressive global tax dodging strategies”

— CICTAR report

Millard and Anglicare did not respond to a series of written questions The Klaxon put to them on Thursday.

The CICTAR report says Millard had been a manager of five Coca-Cola-linked (CCHBC) “shell” companies based in the notorious tax haven of Luxembourg.

The report also reveals Millard was one of two directors of a CCHBC subsidiary in Guernsey, “a British protectorate and another notorious tax haven”.

“No information is provided on its activities or investments, but the two equal shareholders (of the Guernsey-registered company) are listed as Atlantic Industries (Luxembourg) SARL in Luxembourg and CC Beverages Holdings in Netherlands, representing the US Coca-Cola company and the Athens-based CCHBC,” it says.

The 36-page report has been submitted to the Royal Commission on Aged Care and to the senate inquiry into aged care legislation.

(The full submission is published at the senate inquiry’s website here, submission number 11, with Anglicare examined on pages 23-25. Those three pages are shown below.)

“I’ve been a Christian for a long time and my ethical framework always applied in my corporate life”

— Grant Millard

The highly-detailed submission has been accepted by the senate inquiry and so is covered by parliamentary privilege against legal actions such as defamation.

Millard has been under fire for several months, after Coronavirus swept through Anglicare’s Newmarch House aged care facility in Sydney’s west from April 11, infecting at least 71 people and causing the deaths of 19 residents.

The outbreak was “the largest of its kind at that time in Australia”, according to an independent inquiry, whose findings were released two weeks ago.

The explosive new revelations about Millard’s past raise serious questions around his suitability for the role of CEO of Anglicare – which received over $233 million from taxpayers last year alone – and will put the spotlight on the Anglicare board.

The CICTAR report says “Grant Millard may have also been a director/manager of other Coca-Cola tax haven subsidiaries”, including “those in Panama, Liechtenstein or in other tax havens”.

It says company filings “reveal that Grant Millard was a director of a CCHBC finance subsidiary in Northern Ireland and two in England”, despite it “having no physical operations in England”.

“The three UK registered subsidiaries, along with other subsidiaries in the Netherlands, may have been part of alleged global tax dodging schemes at the time.”

———————————————————

More in our Aged Care series:

Aged care giant “based” on Norfolk Island pockets more than island’s entire GDP

Richard Colbeck’s aged care regulator in shambles

NURSING HOME HELL: A Dispatch from the front line

———————————————————

Anglicare’s board includes three clergy, three “lay members elected by the Synod”, three board members elected by the Anglican Archbishop, and up to two more board members appointed by the board itself.

All of those positions are unpaid and voluntary, the CICTAR report says.

Millard’s remuneration is not disclosed in Anglicare’s accounts, but in 2019, nine people comprising Anglicare’s “key management personnel” shared in remuneration of over $2.8m.

Millard declined to respond when asked the value of his 2019 remuneration.

According to CICTAR report, Millard has held CEO positions within Anglicare since 2011.

Before that he spent 13 years at Coca-Cola, the CICTAR report says.

Coca-Cola has been charged billions of dollars by the US Internal Revenue Service over tax evasion and related improper activities.

“In 2015, the US Internal Revenue Service charged Coca-Cola US$3.3 billion ($4.5bn), plus interest, after an audit covering the period 2007 to 2009 for income generated from licensing products in foreign markets,” the CICTAR report states.

In 2003, Coca-Cola used a subsidiary in the Cayman Islands tax haven to sell its product to customers in 75 countries “and avoid paying US taxes on earnings from more than $1.4bn in revenue”.

“For a significant time of his 13-years at Coca-Cola, Grant Millard was at the helm of Coca-Cola’s aggressive global tax dodging strategies,” the report states.

“Coca-Cola was aggressively avoiding income tax payments which deprived governments of billions in revenue to fund health and social services” — CICTAR report

Millard’s bio on Anglicare’s website says he was previously the general manager of the Anglican Church’s Moore Theological College in Sydney, “responsible for all the college’s non-academic activities”.

Millard, who identifies as Christian, has said he applies the same “ethical framework” to his work at Anglicare as he had “always applied” in his corporate life.

Anglicare CEO Grant Millard. Previously at “helm” of Coca-Cola’s “aggressive global tax dodging strategies”. Source: Supplied

“I’ve been a Christian for a long time and my ethical framework always applied in my corporate life,” he has said previously.

“This wasn’t about slamming the door on the evil corporate world. Not all all.”

The 2004 annual report for the Athens-based CCHBC Coca-Cola bottling global giant disclosed three subsidiaries in Luxembourg “where the company had no operations”.

That means the subsidiaries existed only on paper and for tax purposes.

“Luxembourg has been a major tax haven within Europe and is at the core of many multinational tax avoidance schemes,” the CICTAR report states.

The five Luxembourg companies Millard was a manager of held ownership stakes, “directly or indirectly” in CCHBC’s operations, including in Nigeria, Bulgaria, Armenia, Romania and Moldova.

The Luxembourg companies provided “intra-group” loans.

Most of those company filings of the Luxembourg companies stated that they were “not liable to taxes on income” or to taxes “on capital gains”.

“The Luxembourg holding companies also owned 99.99% interests in two companies in Panama and one in Liechtenstein, both notorious tax havens where the company had no operations,” the CICTAR report states.

Millard’s LinkedIn profile. Source: LinkedIn

CICTAR’s report is highly damning of the nation’s largest “not-for-profit” aged care homes.

Its says that just like their for-profit counterparts (such as BUPA and TriCare), the “not-for profit” operators suffered from a “lack of accountability” and appeared to “prioritise investment and growth over care”.

For-profit aged care providers can extract as much money from their facilities as they like.

Not-for-profit operators can “profit” from their activities – but that “profit” can’t be extracted from the company.

Instead, it is often re-invested in the company, such as by buying property.

This “reinvestment” has translated into not-for-profit aged care operators owning vast amounts of wealth, most of it directed from taxpayers.

Money from the activities of the not-for-profit – that might otherwise be characterised as “profit” – can be re-classified as an “expense”, and used to further bolster the salaries and bonuses of the executives of managers of the facilities.

Anglicare currently holds $1.05bn in land and “building improvements”, and has total “plant, property and equipment” worth $1.37bn.

It also holds $420m in “investments and other financial assets” including “corporate bonds and subordinated debt”.

The CICTAR report said prior to Anglicare, Millard had spent “13 years working in senior management roles within the Coca-Cola system in Sydney, London and Athens”, where he had been “responsible for taxation, treasury, risk & insurance and business development”.

“Prior to Coca-Cola he was a partner at Arthur Andersen, the global accounting firm involved in the fraudulent accounting and subsequent collapse of US energy giant Enron,” it states.

CICTAR Report (extract):