Appreciate our quality journalism? Please donate here

One of Australia’s biggest banks, Westpac, has been caught fleecing over $10 million from 11,000 of its customers by charging for “financial advice” that it never actually provided – because they were dead.

Action by the corporate regulator reveals Westpac employees and executives have engaged in widespread illegality, with around $80 million fleeced from “many thousands of customers” over “many years”, yet not one person will be jailed for the crimes – or even face as much as a $1 fine.

The Australian Securities and Investments Commission today said it had launched “multiple actions against Westpac” in the Federal Court for “widespread compliance failures” across “multiple Westpac businesses” in conduct that “occurred over many years”.

The illegal actions – over 88,000 legal breaches have been identified – “caused widespread consumer harm” and “ranged across Westpac’s everyday banking, financial advice, superannuation and insurance businesses”.

The illegality was so widespread that ASIC took the “unprecedented” step of filing “multiple proceedings” against Westpac “at the same time,” ASIC Deputy Chair Sarah Court said in statement.

“These were exceptional circumstances,” Court said.

Yet despite those “exceptional circumstances” – and Westpac having admitted to all of the allegations – ASIC has failed to take any action – criminal or civil – against a single Westpac employee or executive who actually broke the law.

That means that no individuals will be held to account by Australia’s corporate regulator – including even being forced to pay a fine – over the systematic illegality, which Westpac has fully admitted to.

Instead it will be Westpac’s shareholders – including its “mum and dad” investors – who will foot the bill.

“Westpac’s shareholders will foot the bill”

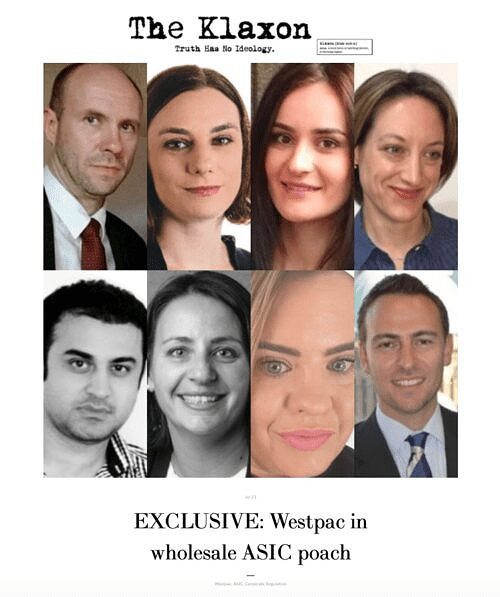

Westpac has been aggressively recruiting ASIC’s top brass. Source: The Klaxon

That bill includes around $80m in “restitution” to customers and around $100m in “combined penalties” – a figure Westpac and ASIC have come up with between themselves, which they say they consider “appropriate” and will take to the court.

As revealed by The Klaxon in July, Westpac has been aggressively recruiting ASIC’s top brass and has at least ten former senior ASIC figures in its ranks.

They include ASIC’s former chief prosecutor; a former chief-of-staff to then ASIC chairman Greg Medcraft; a former senior ASIC forensic financial investigator; and a string of other former key ASIC litigators and enforcers.

Westpac also has very close political connections, with Treasurer Josh Frydenberg’s chief-of-staff, Martin Codina, having repeatedly switched between running Frydenberg’s offices in Canberra and working as an executive and corporate lobbyist at Westpac-BT.

As Treasurer, Frydenberg oversees ASIC.

Frydenberg and Codina have repeatedly declined to comment.

The illegality revealed by ASIC today is extremely serious, widespread and has occurred over many years.

And many of the legal breaches that Westpac employees and executives have engaged in (Westpac has fully admitted that the wrongdoing occurred) can carry extensive jail terms.

The admitted illegality includes:

- Charging $10m to “over 11,000 deceased customers” for “financial advice services that were not provided due to their death”

- Charging 7,000 customers for multiple insurance policies it had needlessly issued over “the same property at the same time”

- Charging over 8,000 superannuation customers $12m in illegal life insurance commissions and for “financial advisors” they’d specifically elected against

- Charging at least 25,000 financial customers “over $7m” in hidden or inadequately disclosed fees

- Charging fees on 21,000 deregistered company accounts it had improperly allowed to remain open

- Charging 16,000 credit card and “flexi-loan debt” customers, who were “likely to be in financial distress”, higher interest rates than Westpac was legally allowed

“ASIC further alleges that in all matters, excluding Debt on-sale and Insurance in super, Westpac failed to ensure that its financial services were provided efficiently honestly and fairly,” ASIC says.

The Klaxon has approached ASIC seeking a response as to why its executive chose to take zero criminal or civil actions against any Westpac employees or executives over the extensive crimes, which Westpac has admitted to.

We are awaiting a response.

More to come…

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.