Highly damaging documents have emerged proving aged care giant Anglicare’s deeply embattled CEO Grant Millard ran a string of “shell” companies in the notorious tax havens of Luxembourg and Guernsey while working at a global arm of confirmed multinational tax cheat Coca-Cola. In the past six years alone, Anglicare has received an eye-watering $1.25 billion from Australian taxpayers. Last week Millard and Anglicare threatened us with serious legal action including an “injunction”, “costs” and demanded an “urgent takedown” of our highly-detailed expose. Now it appears the entire board has gone into witness protection. Plus: Come and meet its chairman. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

The chairman of not-for-profit aged care giant Anglicare – whose CEO previously managed tax affairs at a major international arm of multi-billion dollar global tax cheat Coca-Cola – is a corporate lawyer who was hand-picked by Scott Morrison to steer public policy.

Anglicare Chairman Greg Hammond, a lawyer and “governance” expert, was handpicked by Prime Minister Morrison, then Federal Treasurer, to steer a 2017 financial regulation overhaul.

Hammond was the author of the so-called “Hammond Review” into non-banks, “cooperatives” and mutuals, which called for the relaxing of laws, including so as to allow them to raise funds more easily and face fewer government restrictions.

The Coalition Government responded to Hammond’s report by saying it supported all of his recommendations.

Anglicare chairman Greg Hammond: appointed the tax-haven CEO in 2016. Source: Anglicare

Hammond, according to Anglicare’s website, has “over 30 years’ experience as a banking and finance lawyer”, including “over 27 years” as a partner at multinational law firm King & Wood Mallesons.

The corporate lawyer was appointed “Independent Facilitator” to produce a report for the government on “Reforms for Cooperatives, Mutuals and Member-owned Firms”, and submitted his 70-page report to Morrison in July 2017.

In his biography in the report, Hammond says he has extensive legal experience, specialising in aspects of the “governance, supervision and regulation of Australia’s finance system”.

The latest revelations come as Hammond appears to be backing the tax accountant, fellow corporate lawyer, and former international tax haven shell company operator, he appointed as Anglicare CEO in July 2016.

Hammond’s apparent continuing support for CEO Grant Millard is despite damning revelations by a global tax avoidance specialist that Millard had previously spent 13 years at Coca-Cola, with “a significant time” of that “at the helm of Coca-Cola’s aggressive global tax dodging strategies”.

Hammond has repeatedly declined to comment when asked by The Klaxon whether he had been aware of Millard’s expansive tax haven past when he appointed Millard to the top job in 2016.

The Centre for International Corporate Tax Accountability and Research (CICTAR) report, by principal analyst Jason Ward, an investigative tax expert, said that Millard, before he joined Anglicare, had been “Treasury and Tax Director” at the Athens-based Coca-Cola Hellenic Bottling Company.

Coca-Cola Hellenic Bottling Company, also called Coca-Cola HBC, or CCHBC, is part owned by The Coca-Cola Company (the US multinational based in Atlanta) and controlled by one of Greece’s wealthiest families.

Coca-Cola HBC has operations in 28 countries.

It is the world’s third biggest Coca-Cola bottling company and its shares are listed on the London Stock Exchange.

CICTAR’s forensic report states that Millard’s 13 years directing Coca-Cola’s global tax affairs included a period when Coca-Cola was “aggressively avoiding income tax payments”, depriving governments of billions of dollars that could otherwise be used to “fund health and social services”.

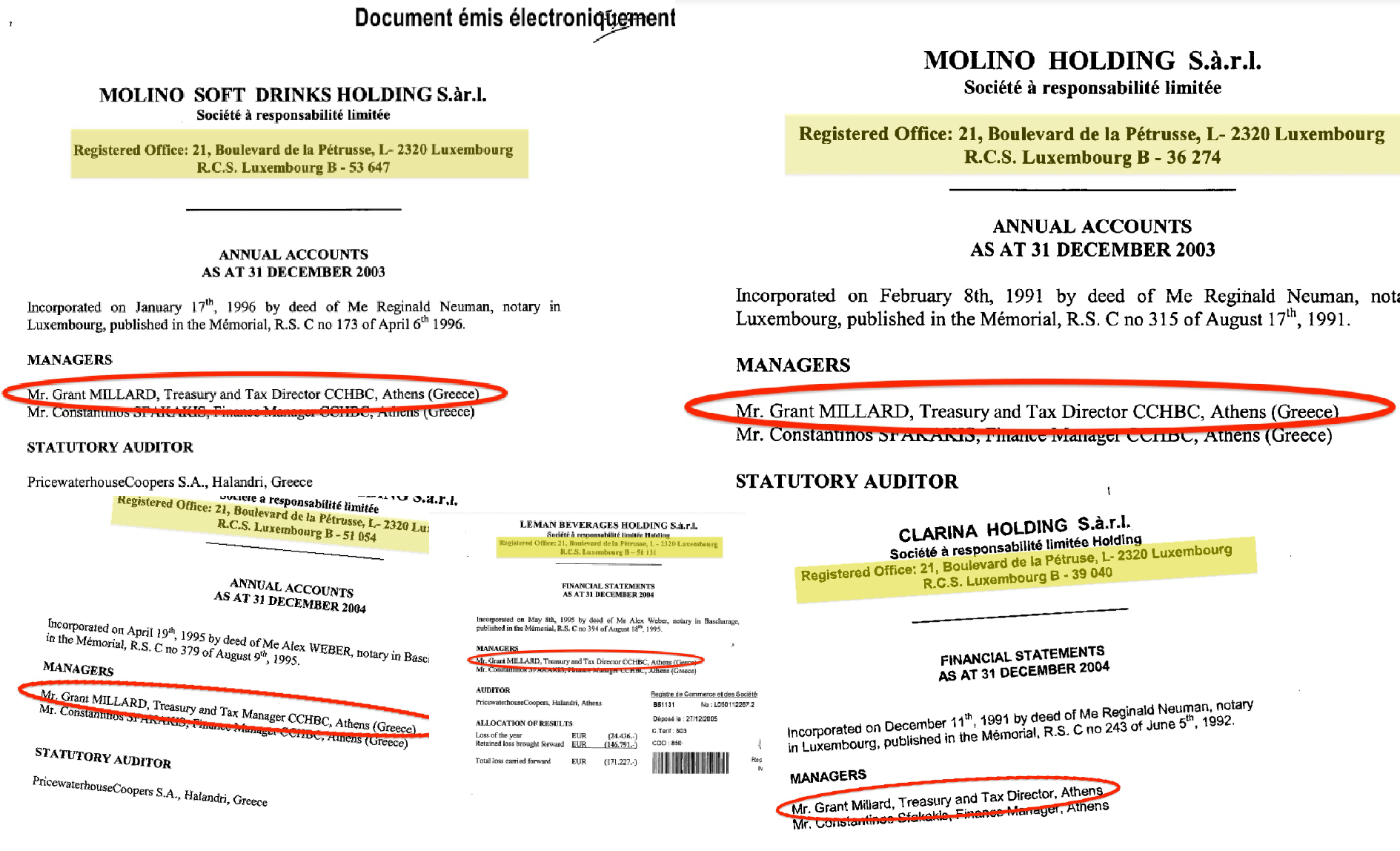

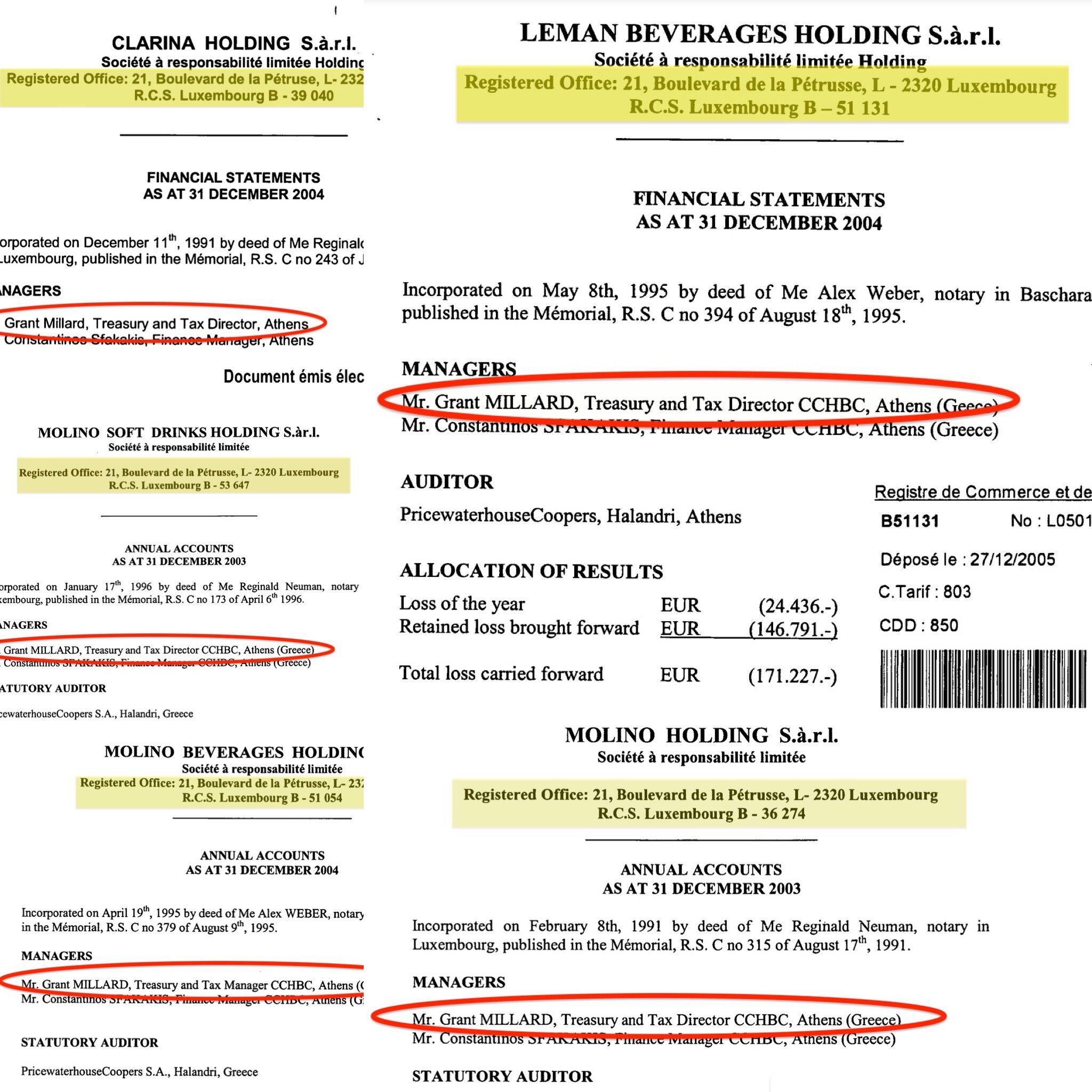

The Klaxon has now exclusively obtained a series of documents that prove Millard ran a string of “shell” companies in the notorious tax haven of Luxembourg.

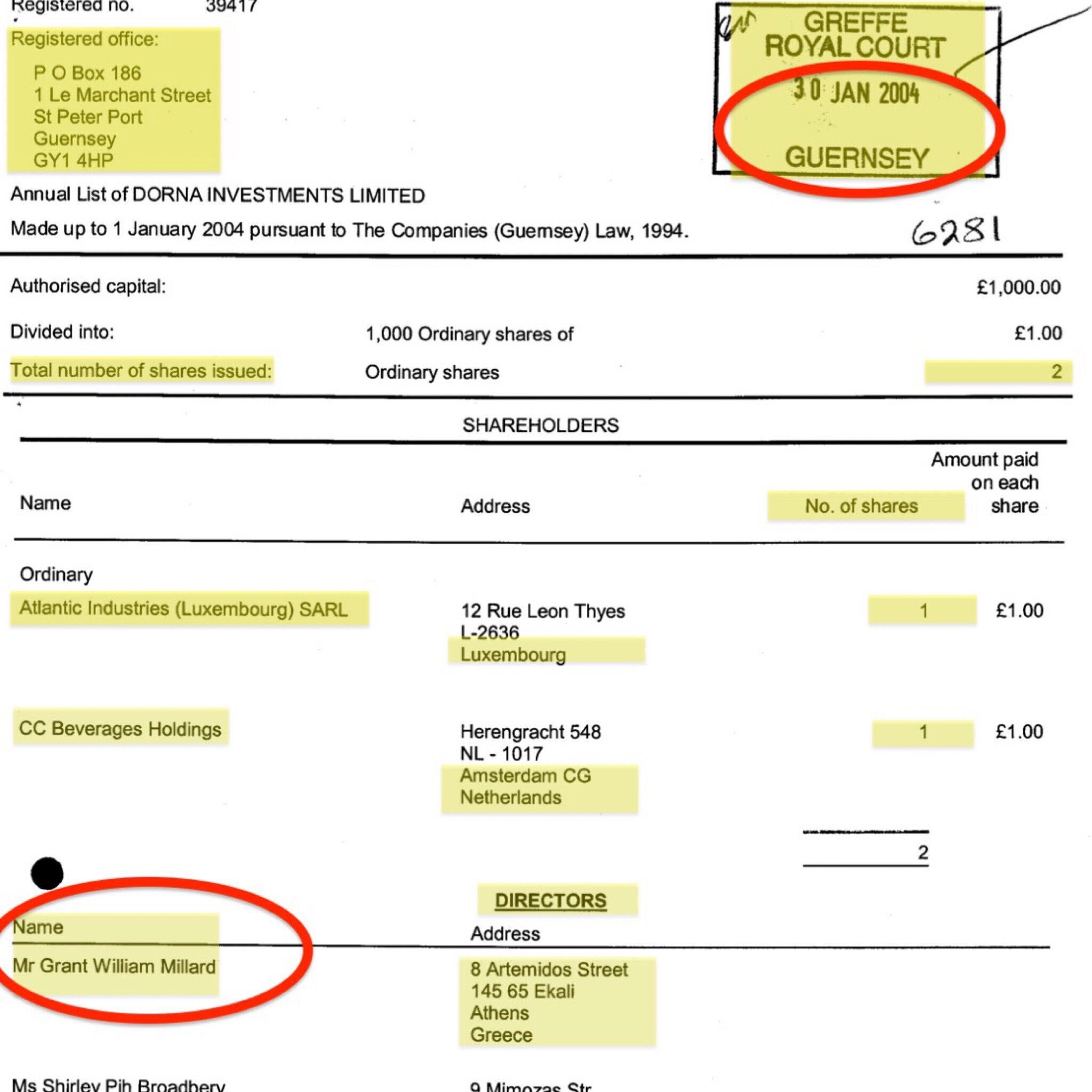

We have also obtained documents proving Millard had been one of two directors of another tax haven shell company, based in the notorious tax haven of Guernsey.

The tax haven files: Proof Anglicare CEO ran shell companies in notorious Luxembourg tax haven while “Tax Director” of Coca-Cola HBC, operating in 28 countries. Source: Supplied

Filings of five companies registered in Luxembourg show that Millard was one of just two “managers” that controlled the companies.

(With Luxembourg companies, the term company “manager” describes what we call company directors).

Although these companies were run by Millard and Coca-Cola HBC, Coca-Cola HBC had “no operations” in Luxembourg, the CICTAR report says.

That means the companies existed only on paper and for tax purposes.

In the CICTAR report, Ward states that the five Luxembourg companies that Millard had been manager of (whose filings we have since obtained) held ownership stakes, “directly or indirectly”, in Coca-Cola HBC’s operations, including in Nigeria, Bulgaria, Armenia, Romania and Moldova.

Those Millard-controlled Luxembourg companies provided “intra-group loans”.

Most of them stated that they were “not liable to taxes on income” or to pay taxes “on capital gains”.

“The Luxembourg holding companies also owned 99.99% interests in two companies in Panama and one in Liechtenstein, both notorious tax havens where the company had no operations,” the CICTAR report says.

Since July 2016, when Millard became CEO, Anglicare has received over $850 million from Australian taxpayers – including $233m in the 2019 financial year alone.

In just the past six years, all with Hammond as chairman, Anglicare has received around $1.25 billion from the nation’s taxpayers.

Anglicare’s accounts report that nine “key staff” were paid $2.8m in the 2019 financial year.

However, the accounts do not disclose how much of that went to Millard, and neither Millard or Hammond (who, along with the Anglicare nine other directors, sets and signs off on Millard’s pay) will say how much of that $2.8m went to Millard.

“Under chairman Hammond, Anglicare has received around $1.25 billion from taxpayers in just six years”

Millard and Hammond are responsible for western Sydney’s now notorious Newmarch House aged care home, where a huge Coronavirus breakout in April and May left 17 people dead and 71 residents and workers infected with the disease.

Two weeks ago, a damning independent report into the tragedy was handed down.

It found that Anglicare had provided care that was “compromised” and “delayed”, and that some residents had suffered from “weight loss, dehydration, pressure sores, increase in urinary tract and skin infections and general de-conditioning”.

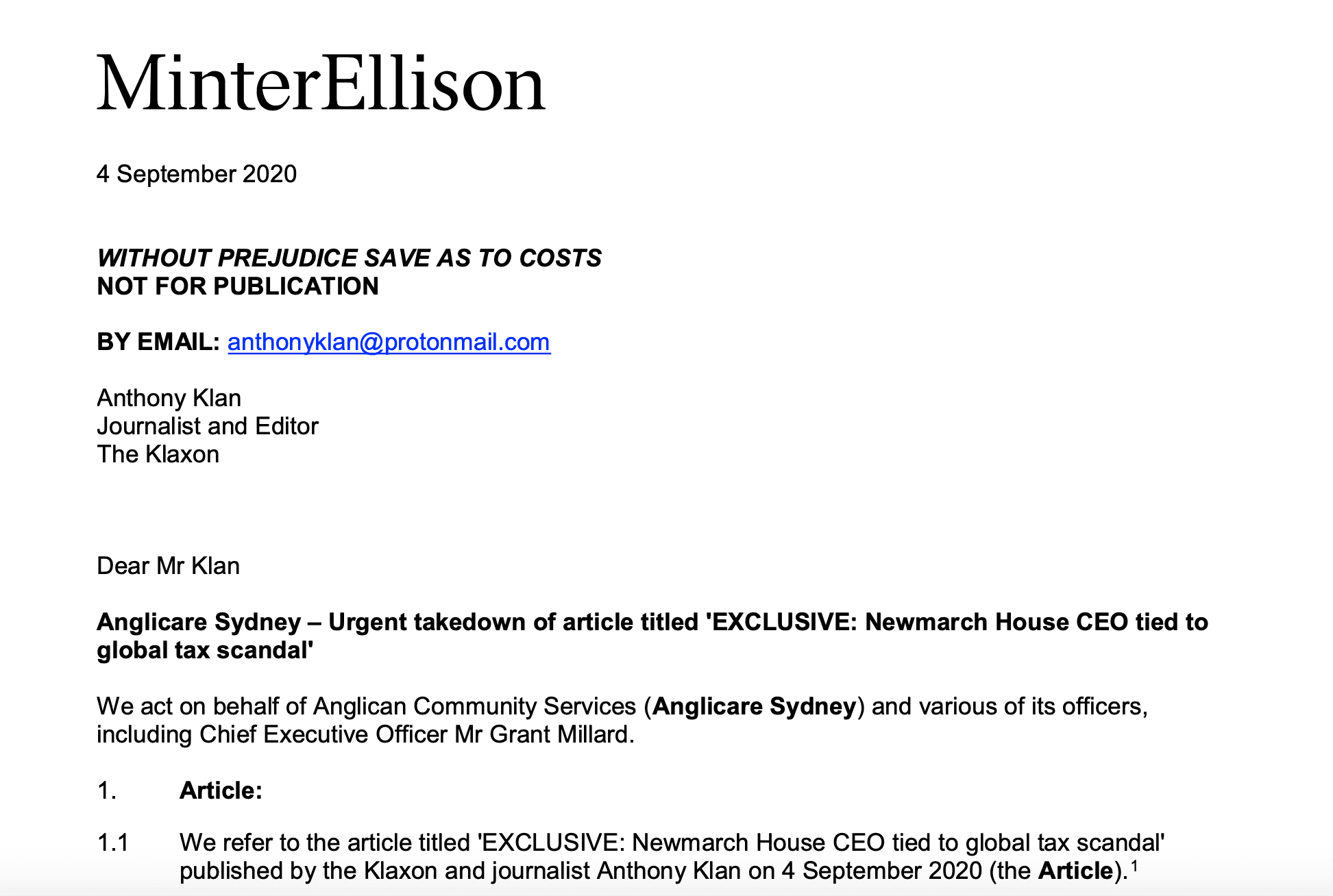

Following our revelations on Friday exposing Millard’s tax haven past, lawyers acting for Millard and “Anglicare” threatened both The Klaxon, and this reporter personally, with serious legal action, including an “injunction”, “costs”, and demanded an “urgent takedown”.

“Our clients will provide more detailed correspondence as a matter of urgency,” said the letter from legal giant MinterEllison.

We have received no correspondence of any kind from MinterEllison, or from any Anglicare representatives, since then.

The Klaxon declined to take down the article, stating that the information it contains is very much in the public interest.

In the letter, which we received last Friday evening, MinterEllison lawyers said they were acting on behalf of “Anglicare Sydney and various of its officers, including Chief Executive Officer Mr Grant Millard”.

The letter did not provide the names of any of those other “various officers”.

MinterEllison, Anglicare, Millard and Anglicare chairman Hammond all failed to respond when repeatedly asked whether Hammond was among those people.

We have requested Millard, MinterEllison and Hammond to provide us with the details, should they exist, of any alleged errors in the CICTAR report.

All have failed to do so.

MinterEllison lawyers representing Anglicare also issued legal threats to the author of the CICTAR report that exposed Millard’s past managing tax affairs at a major international arm of multi-billion dollar global tax cheat Coca-Cola.

CICTAR principal analyst and tax evasion expert Jason Ward said he had also received legal threats from MinterEllison on Friday, hours after The Klaxon’s story was published.

He said MinterEllison failed to identify any errors in his report.

“The ‘unfounded imputations’ you are suggesting are ridiculous”

— CICTAR’s Jason Ward

Ward said he stood by his report “entirely”, that it was in the public interest, and that MinterEllison’s claims were “baseless” and “ridiculous”.

“My report is factual and true and fully documented. It is not defamatory and the information is in the public interest,” Ward wrote back to MinterEllison.

“The allegations of ‘highly defamatory imputations’ against your client Anglicare Sydney and its CEO and board are baseless. The ‘unfounded imputations’ you are suggesting are ridiculous.”

Ward says he has not been contacted by the law firm or by any Anglicare representatives since.

Anglicare CEO Grant Millard: directed global tax operations of international arm of tax cheat Coca-Cola. Source: Anglicare

The CICTAR tax specialist said he had also pointed out to the lawyers representing Millard and Anglicare that it was a crime for any person to hassle another regarding evidence they had submitted to a senate inquiry.

The 36-page CICTAR report has been submitted to the Royal Commission on Aged Care and to the senate inquiry into aged care legislation. (The full submission is published at the senate inquiry’s website here, submission number 11).

“It is an offence for anyone to harass or discriminate against you because you have made a submission”

— Australian Senate

A letter from the Community Affairs Committee of the Australian Senate to Ward, seen by The Klaxon, confirms his CICTAR report had been submitted and would be published by the senate committee, and so be “protected by parliamentary privilege”.

“This means that what you say in the submission cannot be used in court against you or anyone else,” the letter from the Australian Senate says.

“It is an offence for anyone to harass or discriminate against you because you have made a submission.”

The CICTAR report reveals that Millard had been a director of a Cola-Cola HBC subsidiary registered in Northern Ireland, two in England (despite it having no physical operations there), one in the “notorious tax-haven” of Guernsey and at least five in Luxembourg.

The CICTAR report said Millard “may have also been a director/manager of other Coca-Cola tax haven subsidiaries” including “those in Panama, Liechtenstein or in other tax havens”.

_________________________________

AROUND THE WORLD WITH GRANT MILLARD:

– 1x Guernsey, a “British protectorate and notorious tax haven”.

– 5x Luxembourg, a “notorious tax haven” (Luxembourg companies then have stakes in companies in Nigeria, Bulgaria, Armenia, Romania and Moldova)

– 2 x England (despite “no physical operations there”)

– 1x Northern Ireland

– Potentially director/manager of “other Coca-Cola tax haven subsidiaries” around the world, including in Panama and Liechtenstein

Source: CICTAR

__________________________________

Company directors, led by a chairman, are responsible for hiring and overseeing their organisation’s CEO, and for enforcing corporate governance (the “processes by which an organisation is directed, controlled and held to account”) at the company (or companies) they oversee.

Among many other things, directors have a legal obligation to “act honestly”, to “know what the company is doing” and to “act in the company’s best interests”.

Under the Corporations Act, company directors failing to do so face can face penalties ranging from heavy fines to imprisonment.

Hammond and other Anglicare directors did not respond when asked whether they had been previously aware that Millard’s past involved running an international network of tax haven shell companies, as revealed by the CICTAR report.

Friday’s legal letter to us from Hammond and “Anglicare Sydney and various of its officers”, demanded an “urgent takedown” of our expose.

“Anglicare Sydney – Urgent takedown of article titled ‘EXCLUSIVE: Newmarch House CEO tied to global tax scandal’,” the MinterEllison letter said.

“We act on behalf of Anglican Community Services (Anglicare Sydney) and various of its officers, including Chief Executive Officer Mr Grant Millard.”

At the head of the letter were the statements: “WITHOUT PREJUDICE SAVE AS TO COSTS” and “NOT FOR PUBLICATION”.

Legal threats from Anglicare tax-haven CEO Grant Millard after it was exposed he directed global tax affairs of international arm of tax-cheat Coca-Cola. Source: MinterEllison

There is no legal basis for demanding a notice be “not for publication” in these circumstances, and such a demand cannot be legally enforced.

(For example, a person cannot simply walk up to another person on the street, hand them a letter out of the blue, and then demand that person keep the contents of that letter, whatever they happen to be, a secret. They can’t legally enforce that demand, in any rate).

The device is, however, regularly used by lawyers representing clients who are seeking to intimidate or silence journalists.

“Our client makes the following demands,” MinterEllison’s letter states.

“That you, on receipt of this correspondence take down the article forthwith; That you do not further publish or in any way participate in the publication of the Statements or any further defamatory statements of and concerning our client; That you immediately undertake in writing, by return correspondence to comply with the demands listed above.”

“Should you fail to comply with the Demands within 24 hours of receipt of this letter, our clients will not hesitate to seek an urgent injunction against the (sic) Klaxon and Anthony Klan and rely on this letter on the question of costs”. (Emphasis MinterEllison’s).

Since then, The Klaxon has obtained the company filings proving Millard was the director and manager of five companies registered in the Luxembourg tax haven, and one in Guernsey, controlled by Coca-Cola, the US global giant.

In each of the Luxembourg-registered companies, Millard holds the title “Treasury and Tax Director”.

Coca-Cola had no operations in Luxembourg and the company filings were all sent electronically from Greece to Luxembourg.

The Luxembourg-registered companies are Molino Beverages Holding, Clarina Holding, Leman Beverages Holding, Molino Softdrinks Holding, and Molino Holding.

Each of the Luxembourg companies has two directors, Millard, and Constantinos Sfakakis, whose title is “Finance Manager”.

In each case the company filings, for the 2003 and 2004 calendar years, state Millard and Constantinos as being based in Greece.

Millard’s LinkedIn biography shows that of his 13 years with Coca-Cola, Millard spent almost eight years in Greece.

He worked in Greece for Coca-Cola HBC until 2008.

Millard joined an arm of Anglicare in Sydney in 2010 and held various executive roles from 2011, until Anglicare chairman Greg Hammond appointed him CEO in 2016.

Coca-Cola HBC

Coca-Cola Hellenic Bottling Company, is part-owned by Coca-Cola (the US giant) and controlled by one of Greece’s wealthiest families (via their private company, the Kar-Tess Group).

Coca-Cola HBC was established in Greece in 1969 after the US giant The Coca-Cola Company granted it the bottling rights to the country.

In the late 1990’s, Coca-Cola Amatil, which is based in Sydney and which operates across the South Pacific, de-merged from its expansive bottling operations in Europe.

US giant The Coca-Cola Company is, and has long been, a major owner of Coca-Cola Amatil.

In 2000 the Athens-based Coca-Cola HBC merged with the European bottling operations being sold off by Coca-Cola Amatil.

Coca-Cola HBC’s “two parent companies” were then The Coca-Cola Company (the US-based giant) and Kar-Tess Group (of Greece), documents from European Union competition regulator show.

The CICTAR report said Coca-Cola was one of the biggest global tax cheats in history, and has been charged billions of dollars by the US Internal Revenue Service, including US$3.3bn ($4.5bn) regarding offshore licensing-related activities between 2007 and 2009, and, in 2003, using a Cayman Islands subsidiary to avoid taxes on over US$1.4bn ($1.95bn) in revenue.

In last Friday’s legal letter, MinterEllison’s lawyers said they had been “instructed” that “Mr Millard has never had control of the tax affairs of the (sic) Coca-Cola Company”.

Guernsey

The Klaxon has obtained company filings from the tax-haven of Guernsey, which prove Millard ran a company there.

The 2004 filings show Millard was one of two directors of the company, named Dorna Investments Limited, the other “Ms Shirley Pih Broadberry”, also of Athens, Greece.

Dorna Investments Limited was 50% owned by Atlantic Industries (Luxembourg) SARL and 50% by CC Beverages Holdings.

The Luxembourg-registered company Atlantic Industries (Luxembourg) SARL, represents The Coca-Cola Company in the US, while CC Beverages Holdings in the Netherlands represents the Athens-based Coca-Cola HBC, the CICTAR report says.

Millard operated a shell company in tax haven of Guernsey that was half owned by The Coca-Cola Group’s CC Beverages. Source: Supplied

The filings show Dorna Investments Limited, owned by two Coca-Cola giants and run by executives from Greece, one being Millard, had just two issued shares.

This is common among tax haven companies set up purely for accounting and tax purposes.

The way tax havens operate, there is, in most cases, no need for the people who register companies to ever actually set foot in the tax haven country.

Aside from Luxemburg and Guernsey, some of the most prominent tax havens include Lichtenstein (also in Europe) and the Cayman Islands in the Caribbean.

A good explainer of tax havens by the International Consortium of Investigative Journalists, the group that in April 2016 broke the major Panama Papers scandal, the biggest ever expose of secret tax haven company data in history, is here.

“Tax revenue keeps civilisation afloat. But not all taxpayers play by the same set of rules,” the ICIJ states.

“With the help of lawyers, accountants, white-show professionals and complicit Western governments, the wealthy and well-connected have avoided paying trillions of dollars in taxes.

““With the help of lawyers, accountants, white-show professionals and complicit Western governments, the wealthy and well-connected have avoided paying trillions of dollars in taxes”

— ICIJ

Anglicare CEO Millard identifies as Christian, something he reflects in the workplace. (Anglicare is owned by the Anglican Church).

“One aspect of being created in God’s image is that we are relational beings,” Millard wrote in a public bulletin late last year.

“My prayer is that we may be united, bringing honour and glory to Jesus who inspires all that we do.”

Coming soon: Meet the rest of the Anglicare board – the other nine people responsible for Anglicare’s tax haven CEO – as we gradually work our way up the Anglican Church’s chain of command.