The CEO responsible for the Newmarch House Covid disaster was exposed more than six months ago as having run international tax affairs for a global arm of Coca-Cola, one of the biggest confirmed tax cheats in history. The Federal Government – and Anglicare Sydney’s high-powered board – have done absolutely nothing. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Neither the board of aged care giant Anglicare Sydney or the Federal Government has taken any action whatsoever against detailed revelations its CEO – also responsible for the Newmarch House Covid disaster – previously ran international tax affairs for an arm of global tax cheat Coca-Cola.

That’s despite both the Royal Commission into aged care and an ongoing senate inquiry into the sector – comprised of key government figures – having been told of the scandal regarding Anglicare Sydney boss Grant Millard, in high-detail, more than six months ago.

It’s also despite Millard fronting a NSW Government inquiry on Monday – which he was legally forced to attend, after earlier “declining” to do so – into the Covid disaster at Anglicare’s Newmarch House in Western Sydney, where 17 residents died of the virus.

Anglicare Sydney is owned by the Anglican Church, and is one of the nation’s biggest aged care providers.

It received over $233m from Australian taxpayers in the 2019 financial year alone.

Global tax avoidance specialist and analyst Jason Ward, the author of the report that exposed Millard – “the Coca-Cola tax dodger” – said it was “shocking” that no action had been taken against the Anglicare CEO.

Coca-Cola is one of history’s biggest confirmed global tax cheats.

Ward, principal analyst at the Centre for International Corporate Tax Accountability and Research (CICTAR), said the failure to act was a damning indictment of Anglicare’s board, which is responsible for the group’s corporate governance and the hiring and firing of CEOs.

The nine-member board is comprised of a string of accountants and lawyers, as well as some clergy, and is overseen by chairman Greg Hammond, a long-time corporate lawyer.

Hammond and his board appointed Millard, also a corporate lawyer, as well as being an international tax accountant, as Anglicare’s CEO in July 2016.

“It’s pretty shocking to me that he board of Anglicare haven’t responded to those allegations in anyway whatsoever other than issuing legal threats to the people who made them,” Ward told The Klaxon.

“Clearly the behaviour of the CEO isn’t seen as being problematic for the board of Anglicare which is troubling.”

Alongside Hammond, members Anglicare’s board include former Leighton Contractors CFO Peter Hicks; Martyn Mitchell, formerly a PriceWaterHouseCoopers partner of 20 years; Michael Clancy, the current CEO of the Qantas employees super fund, Qantas Super; and Linda Kurti, a senior executive at consultancy giant Urbis.

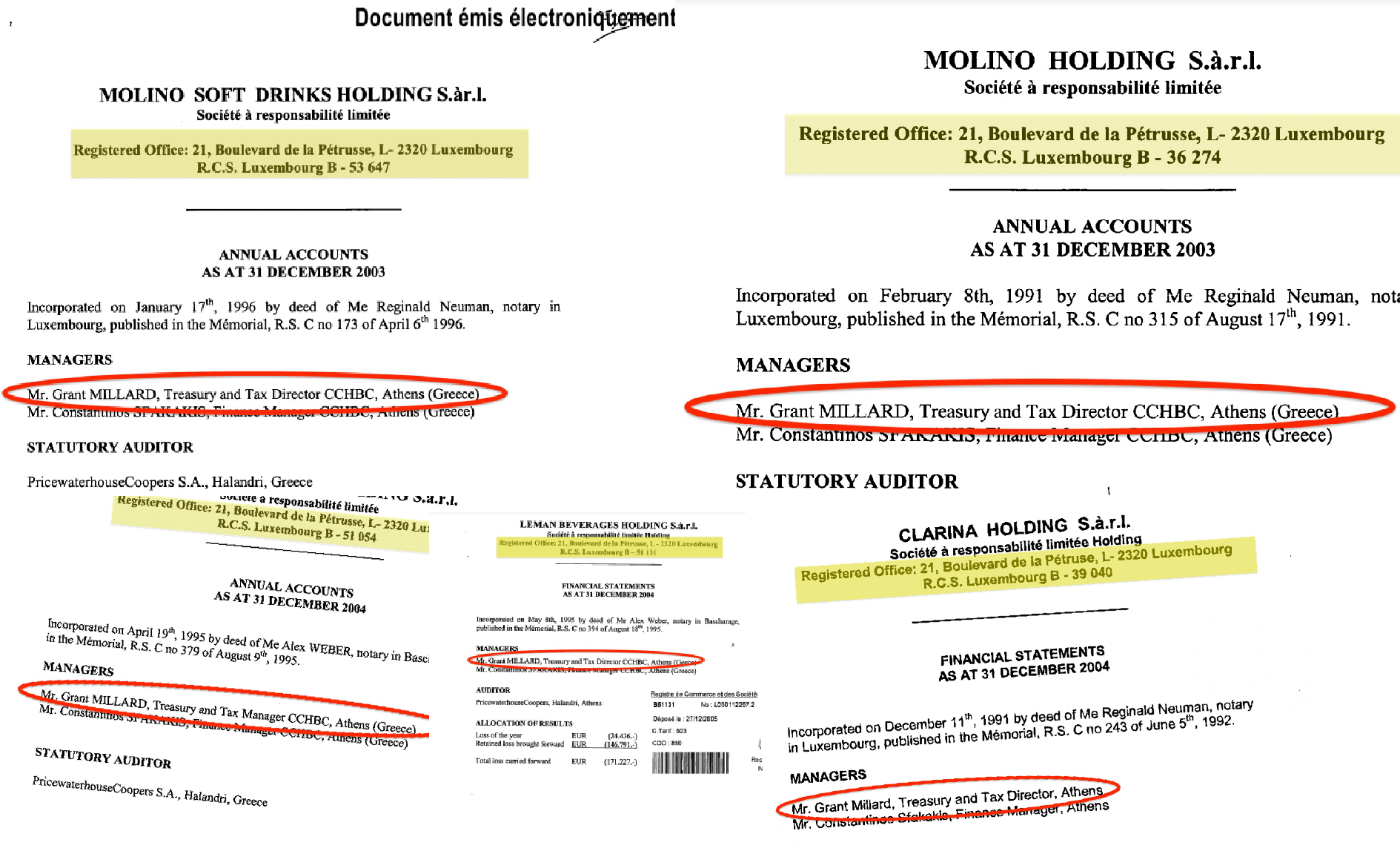

Part of CICTAR’s report regarding Grant Millard. Source:CICTAR

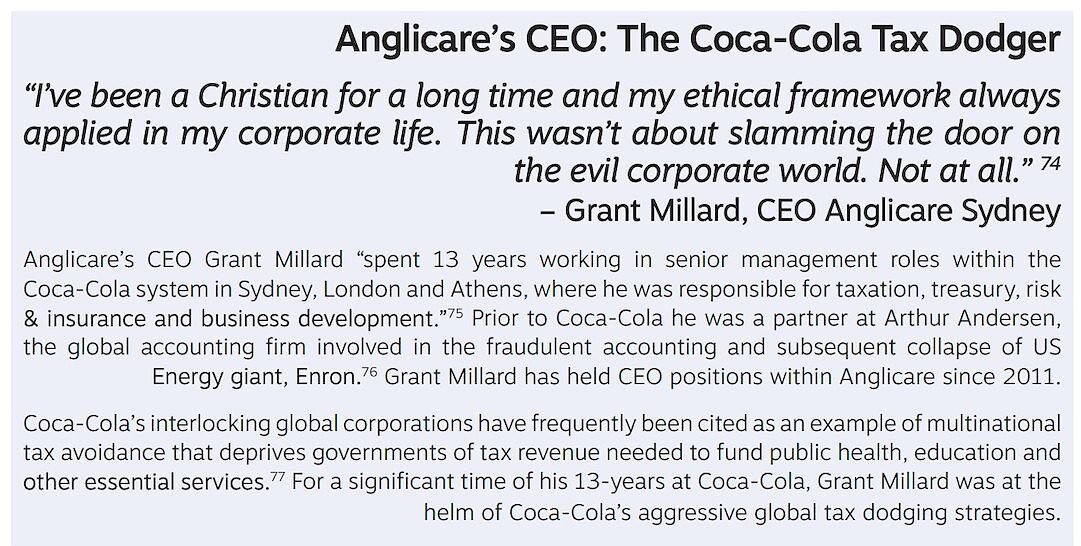

In his forensic report into Australia’s largest non-profit aged care operators, Caring for Growth, released last year, Ward revealed Millard’s long-time past “at the helm of Coca-Cola’s aggressive tax dodging strategies”, having spent 13 years at the global soft drink giant.

(The 36-page report is here, submission 11).

Millard had been “Treasury and Tax Director” at the Athens-based Coca-Cola Hellenic Bottling Company (HBC), which is the world’s third biggest Coca-Cola bottling company, with operations in 28 countries.

Millard’s Manor: “Deep in the tiny, landlocked European tax haven of Luxembourg a three-storey house sits on a leafy suburban street. In the front driveway is a modest grey hatchback…” Read the full story here.

During that period Coca-Cola was “aggressively avoiding income tax payments”, depriving governments of billions of dollars that could otherwise be used to “fund health and social services”, CICTAR’s report said.

The Klaxon subsequently exclusively obtained a series of documents proving Millard, while running international tax affairs at Coca-Cola HBC, ran a string of “shell” companies in notorious tax haven of Luxembourg (among other tax havens), despite the bottling giant’s own accounts revealing it had no actual operations there.

Ward said the failure of the Anglicare board to engage whatsoever regarding the damning revelations was particularly concerning, given Anglicare’s business was run with taxpayer funds.

“It’s a reflection of who’s on the board of Anglicare and these other large non-profits that are dominated by these big corporate executives who view this as normal behaviour, that tax dodging is just what businesses do, ” Ward told The Klaxon. “Despite the fact that they all run businesses that rely on taxpayer funding.”

Anglicare, and each of its nine board members, has repeatedly refused to comment when contacted by The Klaxon over the past seven months.

———————————————————

More in our Anglicare series:

Hire more “messengers”: Anglicare silent but PR overhaul

Millard’s Manor: Meet tax haven CEO’s tax haven HQ

Anglicare tax haven CEO: The Luxembourg Files

Newmarch House CEO tied to global tax scandal

———————————————————

Instead, hours after The Klaxon broke the story about Millard’s tax haven past, on September 4 last year, lawyers for Millard issued Ward, The Klaxon, and this reporter personally, with serious legal action.

That included threatening an “injunction”, “costs”, and demanding an “urgent takedown” of the article.

The Klaxon refused. We do not consider the article to be defamatory as it reports the truth. It is also very much in the public interest.

“Bartlett was also the go-to “defamation” lawyer of choice for Christian Porter”

— The Klaxon

Acting for Anglicare was “top-tier”, and highly expensive, legal firm MinterEllison, represented by Peter Bartlett, one of the firm’s senior partners.

Bartlett was also the go-to “defamation” lawyer of choice for Christian Porter when in recent weeks the then Attorney-General, made general legal threats against “the media”, regarding reports that he had allegedly raped a woman in 1988.

When MinterEllison’s CEO Annette Kimmitt last month learnt that Bartlett had agreed to represent Porter, she wrote to staff that the matter “is clearly causing some hurt to some of you” and that it had “certainly triggered hurt for me”.

Filings for the five Millard companies registered to 21 Boulevard de la Petruse. Source: Supplied

In response, MinterEllison’s board fired Kimmitt, sparking outrage.

(Porter is currently suing the ABC – at taxpayer’s expense, on both sides – and was stood down as Attorney-General, the nation’s top law officer, in last week’s cabinet reshuffle. Bartlett’s name has so far not emerged as being connected with Porter’s suing of the ABC, which has been described as the “trial of the century”.)

CICTAR’s Ward responded to MinterEllison saying that he stood by his report “entirely”, that MinterEllison’s claims were “unfounded” and “ridiculous”, and that the law firm had failed to identify a single error.

Neither The Klaxon or Ward has heard from MinterEllison, Bartlett, or Anglicare since.

Peter Bartlett. Source: MinterEllison

Bartlett’s profile at Minter Ellison states he works “with a team that leads the media reputational protection field in Australia and internationally”.

“I thrive on challenges,” he writes.

Each of Anglicare’s nine board members refused to comment when asked whether they considered spending taxpayer funds engaging expensive legal firms to attack media outlets, for exposing issues in the public interest, was in line with corporate governance and ethical protocols.

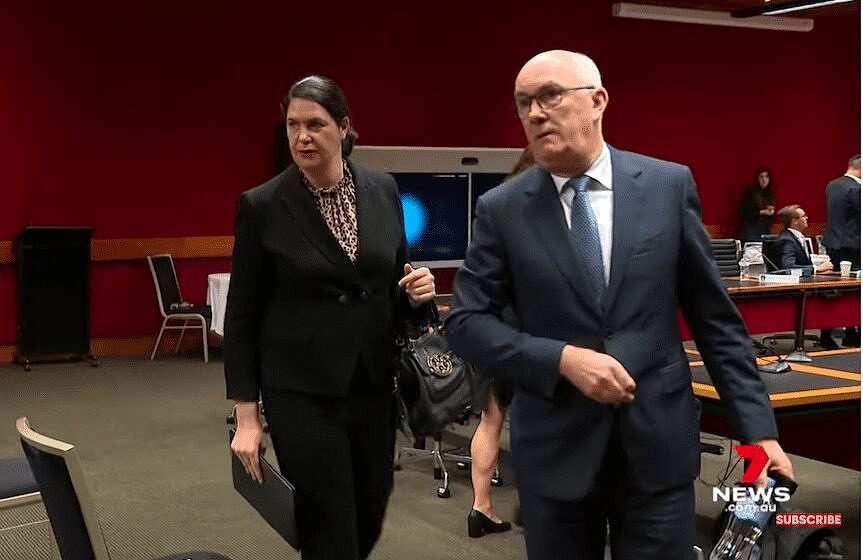

On Monday their CEO, Millard, appeared before a NSW parliamentary inquiry into the disaster at Anglicare Sydney’s Newmarch House, where 17 residents died after Covid swept through the facility from April 11 last year.

Millard had been “summoned” to the inquiry – that is, legally forced to appear – because he had earlier refused an “invitation” to attend (the normal protocol).

That was despite the inquiry being solely about Newmarch House, which Millard, as Anglicare Sydney CEO, was and is fully responsible for.

Millard told Monday’s hearing that Anglicare Sydney had “faced significant difficulties accessing PPE (protective equipment)”.

Yet, the NSW Government has said it supplied “tens of thousands” of items.

Having been criticised for failing to hospitalise infected residents, Millard on Monday admitted he had not pushed for hospital admissions.

Anglicare CEO Grant Millard leaves Monday’s hearing. Source: 7 News

In response, NSW Health said: “Hospital care was always available, and is always available, to aged care residents”.

Millard, who identifies as Christian, has said he applies the same “ethical framework” to his work at Anglicare as he had “always applied” in his corporate life.

“I’ve been a Christian for a long time and my ethical framework always applied in my corporate life,” he has said previously.

Colbeck

Federal aged care mister Richard Colbeck has repeatedly refused to respond over the past seven months when contacted for comment by The Klaxon regarding the Anglicare scandal .

Private aged-care giant, “based” in Pacific tax haven, handed mystery $25m: Federal Government silent. Source The Klaxon.

Colbeck and his office also repeatedly refused to respond when contacted regarding private aged care operator TriCare, which receives hundreds of millions of dollars of taxpayer funds from the Federal Government each year, despite operating sham “headquarters” from Norfolk Island, a long-time tax haven.

Last month The Klaxon revealed that the Federal Government had not only taken zero action regarding the TriCare tax haven revelations, it had handed the company a mystery additional $25m, despite TriCare actually providing fewer beds.

The Federal Government last month said it was considering increasing taxes, such as by introducing a new Medicare-style income tax levy, in order to give more money to aged care operators.