Every one of the five companies Anglicare CEO Grant Millard is known to have operated in the notorious tax haven of Luxembourg – while he ran global tax affairs at an arm of international tax cheat Coca-Cola – is registered to one, single, unmarked house. The address, which also appeared in the Panama Papers, is home to scores of shell companies. It’s also home to a consulate for the African nation of Chad. Meet Millard’s Manor. Anthony Klan reports.

Appreciate our quality journalism? Please donate here

EXCLUSIVE

Deep in the tiny, landlocked European tax haven of Luxembourg a three-storey house sits on a leafy suburban street.

In the front driveway is a modest grey hatchback.

Next door some renovations are underway; a worker looks up casually as a car passes by.

It’s a prosaic, sleepy scene.

But the house at 21 Boulevard de la Petrusse, Luxembourg, is anything but ordinary.

The property, which carries zero markings or signage, is legally “home” to scores of companies, whose owners need never have set foot in Luxembourg, much less ever visited the three-level house at 21 Boulevard de la Petrusse.

The dwelling is also home to five companies that were operated by now Anglicare CEO Grant Millard: when Millard headed global tax affairs for a major international arm of Coca-Cola, a confirmed multinational tax cheat.

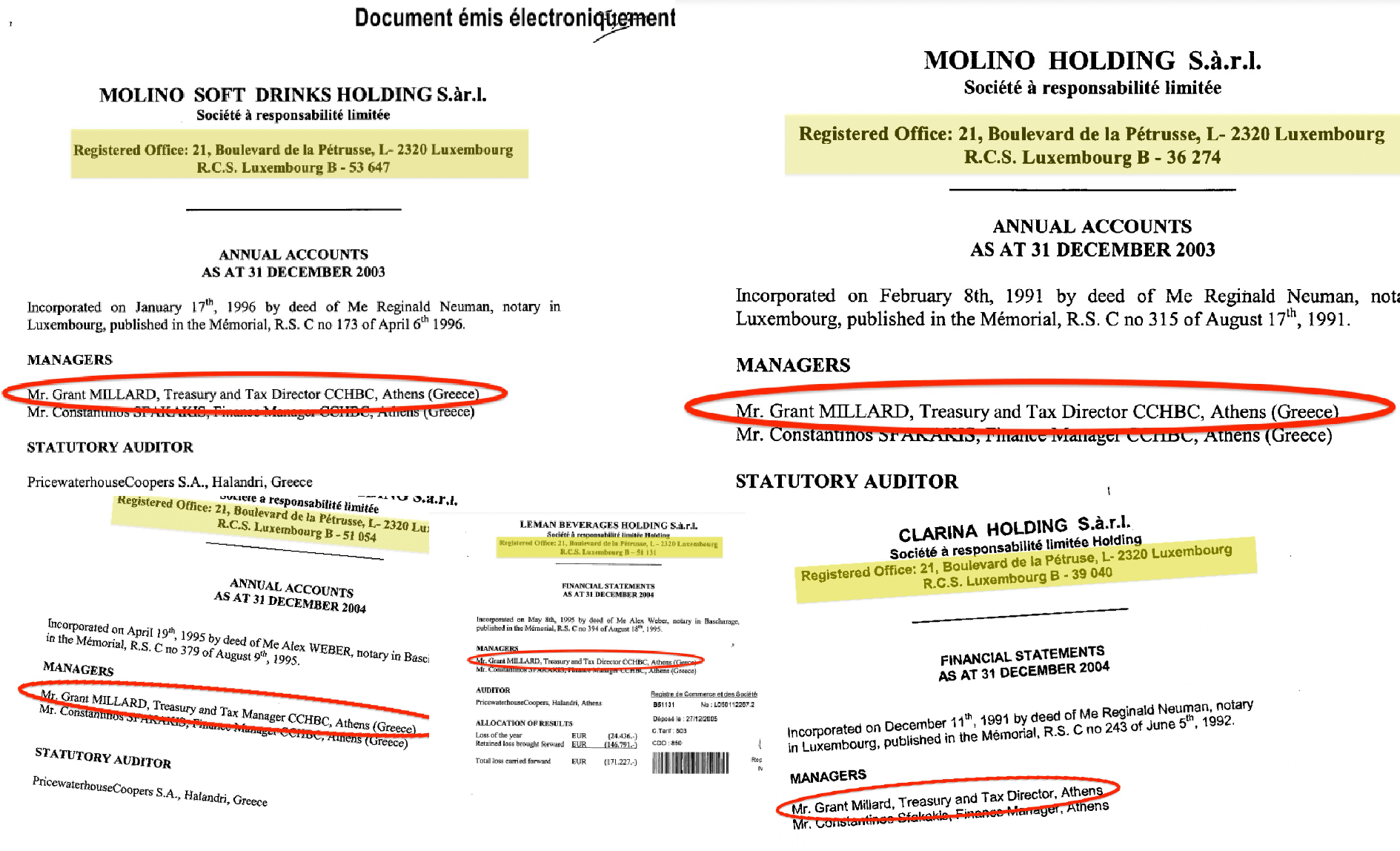

Company filings show Molino Soft Drinks Holding, Molino Holding, Leman Beverages Holding, Clarina Holding and Molino Beverages Holding were all operated from the exact same “registered office” – 21 Boulevard de la Petrusse, Luxembourg.

Anglicare, a so-called “not-for-profit”, is one of Australia’s biggest aged care operators, and receives over $230 million a year from Australian taxpayers.

Tax havens are used by some corporations and wealthy individuals (via their accountants and lawyers) to obscure their operations and avoid paying taxes in the countries where they actually operate.

21 Boulevard de la Petrusse. Pic: Google Street View

Luxembourg is one of the world’s most notorious tax havens, according to experts, with the tiny nation used to launder hundreds of millions of dollars a year, depriving governments of tax revenue that could otherwise be used to provide education and healthcare.

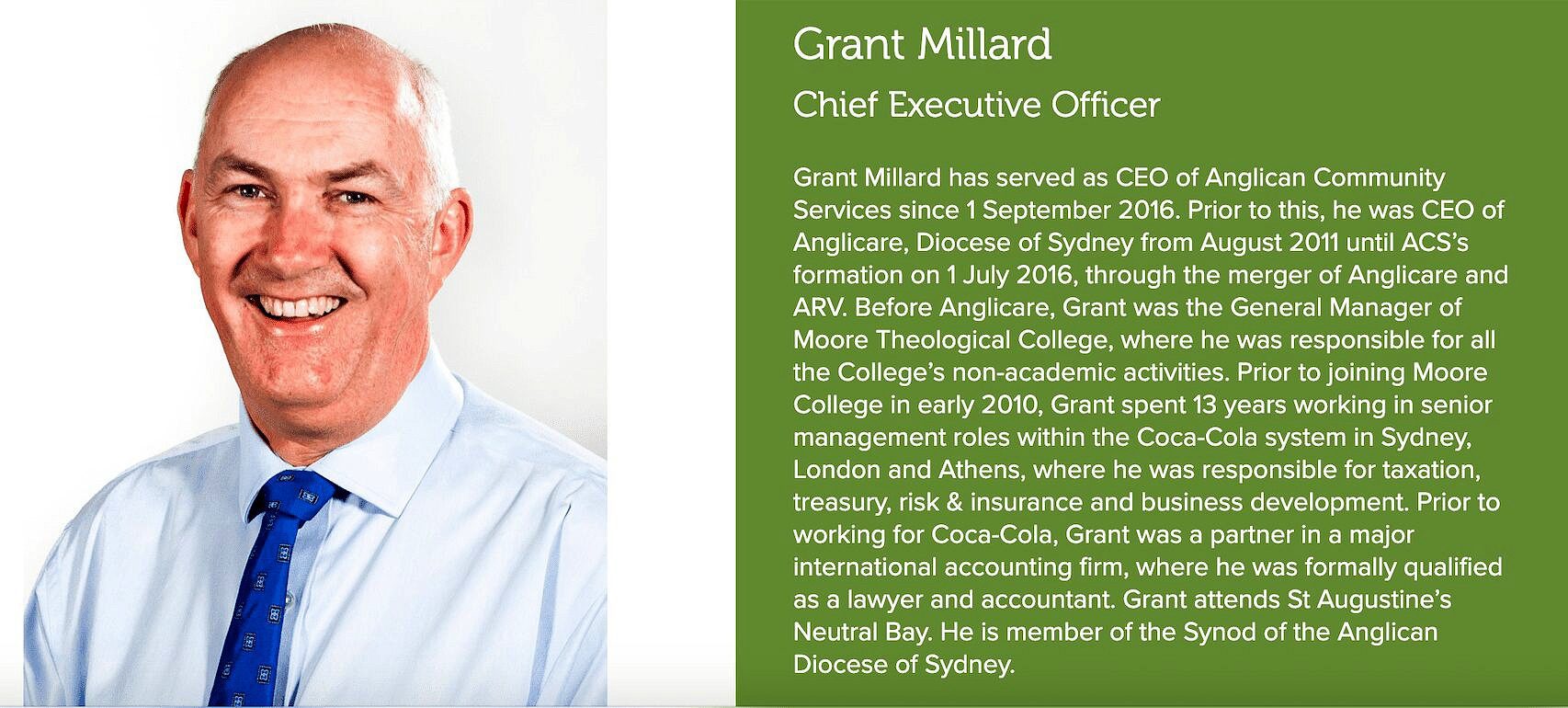

Millard, a tax accountant and corporate lawyer, spent 13 years at Coca-Cola, until 2008, before joining Anglicare in 2010.

Much of his time was spent working as “Treasury and Tax Director” for Coca-Cola Hellenic Bottling Company (Coca-Cola HBC).

Coca-Cola HBC is the world’s third largest bottler of Coca-Cola products and is part-owned by The Coca-Cola Company, the global giant based in Atlanta, USA.

Coca-Cola HBC was founded in Athens, Greece, but has operations – ie bottling Coca-Cola products – in 28 countries.

However, it had no operations in Luxembourg, according to a recent investigation by the Centre for International Corporate Tax Accountability and Research (CICTAR).

Company filings for 2003 and 2004 show Millard was a director and manager of each of the five Luxembourg companies – while working from his offices at Coca-Cola HBC, in Greece, 2,300km away.

In each case, Millard was one of just two manager/directors controlling the companies.

Millard and Anglicare chairman Greg Hammond have repeatedly refused to comment when approached by The Klaxon.

Filings for the five Millard companies registered to 21 Boulevard de la Petruse. Source: Supplied

Financial Engineering:

What is located at 21 Boulevard de la Petrusse is Sofinex SA, a corporate services firm that specialises in creating Luxembourg-registered shell companies.

The firm creates Luxembourg “head offices” for companies the are actually based around the globe.

“Sofinex SA will register, in Luxembourg, the Representative Office, Branch Office or Head Office of your foreign-based company,” its website says.

For clients it can create a “real domicile in Luxembourg”; the establishment of a “bank account in Luxembourg” including “internet banking and credit cards”; the “preparation of all company documents”; the “preparation and execution of ordinary and extraordinary general meetings”; the “execution of directors’ meetings” and provide “auditors’ attestations”.

Sofinex SA describes itself as a “Luxembourg-based firm” that specialises in “tax services”, “accounting”, “company administration” and “fiscal and financial engineering”.

Under the heading “Tax Engineering”, the company states: “International tax planning is a core competency of our consulting services”.

The company also specialises in “assets structuring”.

“Sofinex SA offers consulting on the incorporation of legal entities, as well as the transfer of any type of assets to these entities – with the objective of separating personal from structural assets (necessary in the context of succession planning, creditor protection, mobility/flexibility and discretion),” its website states.

———————————————————

More in our Aged Care series:

Anglicare tax haven CEO: The Luxembourg Files

Newmarch House CEO tied to global tax scandal

Richard Colbeck’s aged care regulator in shambles

———————————————————

Its clients include “international organisations”, “financial institutions and their clients” and “private individuals”.

“Sofinex SA, since 1994, invites you to discover the opportunities that exist in the Grand Duchy of Luxembourg, a country that owes its success to a legal and fiscal framework, particularly suitable for all kinds of business ventures.”

A simple Google search reveals scores of shell companies all with the quaint home at 21 Boulevard de la Petrusse registered as their address.

The property was mentioned in the Panama Papers – the massive, 2016, leak of millions of files from Panama-based offshore law firm Mossack Fonseca.

Included in the Panama Papers cache of documents is a company called BTS Trading Inc. whose “jurisdiction” is named as Seychelles (another notorious tax haven) and whose address is listed as being 21 Boulevard de la Petrusse, Luxembourg.

Chad

The managing director of Sofinex S.A. is Antoine Hientgen.

Remarkably, Hientgen also operates the Luxembourg consulate for the impoverished African nation of Chad.

Hientgen is listed as “ambassador” and “honorary council” for the Chadian consulate in Luxembourg.

The Chadian consulate’s address is listed as 21 boulevard de le Petrusse, Luxembourg.

“For an appointment at the Chadian consulate in Luxembourg, please check in the first instance the consulate website,” one site says.

“In the case that you are not able to arrange an appointment through the website, you can contact the consulate in Luxembourg Ville by telephone…or email ah@sofinex.com”.

Luxembourg government documents suggest Hientgen has been the Chadian Honorary Consul to Luxembourg since 2005.

Hientgen did not respond to requests for comment.

Anglicare CEO Grant Millard. Source: Anglicare

According to the CICTAR report, which has been submitted to an ongoing senate inquiry into aged care, Millard spent a “significant time” of his 13 years at Coca-Cola “at the helm of Coca-Cola’s aggressive global tax dodging strategies”.

Millard’s time at Coca-Cola included a period when Coca-Cola was “aggressively avoiding income tax payments”, depriving governments of billions of dollars that could otherwise have been used to “fund health and social services”, the CICTAR report states.

According to the report, the five Millard-controlled Luxembourg companies – all registered at 21 boulevard de le Petrusse – held ownership stakes in Coca-Cola HBC’s operations, including in Nigeria, Bulgaria, Armenia, Romania and Moldova.

Those companies provided “intra-group loans”.

Filings show that most of the companies stated they were “not liable to pay taxes on income” or to pay taxes on capital gains.

Those Millard-controlled Luxembourg companies also owned 99.99% interests in two companies in Panama and one in Liechtenstein.

Both Panama and Liechtenstein were “notorious tax havens” where Coca-Cola HBC “had no operations”, the CICTAR report says.

As well as the string of Luxembourg shell companies, Millard had also been one of two directors of a shell company in the notorious tax haven of Guernsey.

In the 2019 financial year Anglicare received $233m from Australian taxpayers.

Since July 2016, when Millard became CEO, the Anglican Church-owned aged care giant has received over $850m from taxpayers.

In just the past six years, all during Hammond’s tenure as chairman, Anglicare has received around $1.25 billion from taxpayers.

In the 2019 financial year alone, nine “key staff” at Anglicare, including Millard, were paid $2.8m.

After our first highly-detailed expose detailing Millard’s tax-haven past, Millard sent serious legal threats to The Klaxon, including threatening an “injunction”, “costs” and demanding an “urgent takedown” of the article.

Since then, and despite our repeated requests for comment, we have received zero correspondence from Millard, Hammond – who is also a corporate lawyer – or from any other representative of Anglicare.

Do you know more? anthonyklan@protonmail.com

Help us get the truth out from as little as $10/month.

Unleash the excitement of playing your favorite casino games from the comfort of your own home or on the go. With real money online casinos in South Africa, the possibilities are endless. Whether you’re into classic slots, progressive jackpots, or live dealer games, you’ll find it all at your fingertips. Join the millions of players enjoying the thrill of real money gambling and see if today is your lucky day!

The need for fearless, independent media has never been greater. Journalism is on its knees – and the media landscape is riddled with vested interests. Please consider subscribing for as little as $10 a month to help us keep holding the powerful to account.